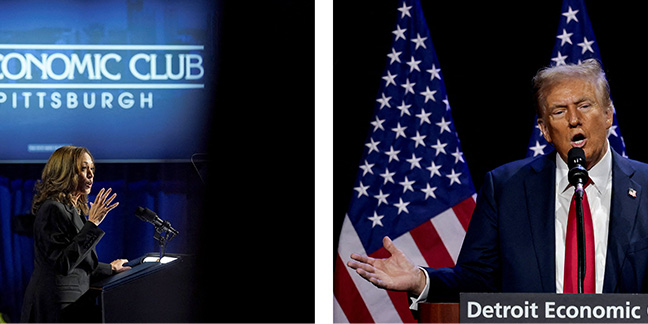

WASHINGTON, D.C. — In the final days of the 2024 U.S. presidential campaign, it's a question on the minds of many a political pundit: Will Americans find themselves fixated on the economy, and how will they vote with their wallets and pocketbooks between now and Election Day, Nov. 5?

WASHINGTON, D.C. — In the final days of the 2024 U.S. presidential campaign, it's a question on the minds of many a political pundit: Will Americans find themselves fixated on the economy, and how will they vote with their wallets and pocketbooks between now and Election Day, Nov. 5?

An Oct. 21 poll by The Associated Press-NORC Center at the University of Chicago reveals that 62% of registered voters feel -- despite improvements -- the nation's economy is still in bad shape.

Selected economic issues polled by AP-NORC indicate mixed results in terms of voter trust to engage these challenges: With regard to taxes on the middle class, 46% trust Harris, while 36% trust Trump; jobs and unemployment, 43% Harris, 41% Trump; the cost of housing, 42% Harris, 37% Trump; the cost of groceries and gas, 40% Harris, 42% Trump; tariffs (taxes on imported goods), 37% Harris, 42% Trump.

At least 10% of voters didn't trust either candidate more than the other in any category.

"Economic policy tends to be where candidates are the weakest, from an economist's perspective," said Hannah Kling, assistant professor of data analytics and economics at Belmont Abbey College in Belmont, North Carolina.

Jesús Fernández-Villaverde -- an economist at the University of Pennsylvania and president of CREDO, the Catholic Research Economists Discussion Organization -- was even bleaker in his assessment.

"Both campaigns," said Fernández-Villaverde, "have competed with each other in a race to the bottom in terms of the quality of the arguments."

Republican candidate and former President Donald Trump's "20 Core Promises" -- his campaign website's personal platform -- lists a number of economic pledges, including, "End inflation, and make America affordable again"; "Stop outsourcing, and turn the United States into a manufacturing superpower"; "Large tax cuts for workers, and no tax on tips!"; "Keep the U.S. dollar as the world's reserve currency"; "Fight for and protect Social Security and Medicare with no cuts, including no changes to the retirement age"; and "Unite our country by bringing it to new and record levels of success."

The Republican Party platform adds that these goals will be met through new energy programs relying on oil, natural gas, and nuclear power; reining in "wasteful federal spending"; regulation cuts; and an end to illegal immigration and global conflict. The platform also proposes making permanent the Trump Tax Cuts and Jobs Act (2017), and an "America First Trade Policy." Housing affordability will come from reduced mortgage rates, extra construction, tax incentives, and deregulation; affordable healthcare and lower everyday costs are also pledged.

Democratic candidate and Vice President Kamala Harris' campaign website likewise emphasizes tax cuts for middle-class families; affordable rent and increased home ownership through additional building, deregulation, and $25,000 to help first-time homebuyers; tax deductions for small businesses; taking on "bad actors" to bring down costs; a reduction in the cost of health care; protection of Social Security and Medicare; support for American workers and innovation, including a promise to "fight for unions" and "sign landmark pro-union legislation"; affordable education, child care, and long-term care; and the lowering of energy costs.

The Democratic Party platform also specifically addresses fighting poverty, the end of "special interest giveaways," and "making the wealthy and big corporations pay their fair share." Also included are policies to tackle home care and paid leave, gas and groceries, and corporate greed.

Both candidates have emphasized the child tax credit, a federal tax break that currently provides up to $2,000 per child to about 40 million American families every year. Without congressional action, however, this will expire Dec. 31, 2025, and the child tax credit will return to $1,000 per child after 2025.

Harris has suggested a robust increase that gives parents $6,000 per child for the first year after birth and $3,600 per year for every qualifying year after that.

Some pro-family researchers have pointed to findings indicating that giving robust child allowances to parents could have both anti-poverty and pro-life effects by lifting households with children out of poverty and alleviating some of the economic push-factors behind abortion. In the U.S., abortion correlates heavily with low-income levels, with seven out of 10 women telling researchers at the Guttmacher Institute that they could not afford a baby as an important factor into why they had an abortion.

Trump's running mate, Ohio Sen. JD Vance, floated a child tax credit of $5,000 per child, but Trump's campaign did not commit to that proposal. The 2024 GOP platform does commit Republicans to make permanent the child tax credit's expansion to $2,000 per child under the Tax Cuts and Jobs Act.

Fernández-Villaverde said inflation, immigration, and housing will likely drive voters' economic choices.

"Inflation tends to hurt more the middle- and the lower-income families," he noted. "In particular, during this cycle, inflation was very concentrated in food and electricity. Electricity prices would have a disproportionate impact on these groups."

Immigration, he said, "has put a lot of pressure, I think, on public services; on state and local government budgets; and also on some labor markets."

However, "The big issue is housing prices," Fernández-Villaverde emphasized. "There has not been enough housing construction in the U.S. over the last decade or so -- and there's some clear stress in the housing market."

If Trump carries out his proposed mass deportation plan, "that will probably, on one hand, slow down the economy a little bit -- because there will be a tighter labor market," Fernández-Villaverde predicted. "On the other hand, workers in the U.S. will enjoy a little bit of higher wage growth."

Analysts at Goldman Sachs -- a leading global investment banking and wealth management firm -- found the economy would continue to grow under both candidates.

Their respective policies could, however, impact that growth at different rates.

Kling noted that tariffs -- which Investopedia defines as "a tax imposed by one country on the goods and services imported from another country to influence it, raise revenues, or protect competitive advantages" -- could harm trade.

"Tariffs are really terrible economic policy," she declared. "They distort the economy; they make things more expensive for all consumers -- but everyone thinks they're super popular. So both Harris and Trump really are proposing a lot of tariffs."

The candidates' emphasis on housing should, in Kling's view, focus on regulations.

"If we could get local governments to remove some of the restrictions on building, that is the solution for high housing prices. Giving everyone $25,000 toward a home -- that's only going to push up the price of housing by that amount," she contended. "If we want to fix housing prices, we have to fix housing supply."

Pursuing price-gouging policies on groceries and other goods, Kling predicted, could create its own problems.

If prices are substantially lowered, explained Kling, "You're going to have way more people wanting to buy at that price than can, and you're going to have fewer people supplying -- maybe because they can't cover their costs. That's what's known as a shortage," explained Kling, "and I sure don't want that."

Harris revisited her strategies to combat price gouging in an Oct. 23 CNN town hall, which Trump declined to attend.

"Part of my plan," Harris said, "is to create a new approach that is the first time that we will have a national ban on price gouging -- which is, companies taking advantage of the desperation and need of the American consumer and jacking up prices without any consequence or accountability."

As the race stretches into its final days, Catholics remain evenly divided about the candidates even as concerns about the economy remain in the forefront.

Anthony Annett, author of "Cathonomics: How Catholic Tradition Can Create a More Just Economy," suggested the framework of Catholic social teaching as a tool for Catholics to assess the candidates' policy positions.

In November 1996, the U.S. Catholic bishops released "A Catholic Framework for Economic Life" to help guide Catholics on these questions with the church's teaching.

Among the principles it outlines are, "The economy exists for the person, not the person for the economy." The framework adds, "All economic life should be shaped by moral principles." It also observes, "A fundamental moral measure of any economy is how the poor and vulnerable are faring." It further emphasizes a right to "the basic necessities of life," as well as "just wages."

Annett said applying Catholic social teaching should begin with questions as to whether proposed economic policies will favor people in poverty rather than the wealthy, and especially how they will favor workers.

"You want to ask how policies will affect real wages," continued Annett: "How they will affect the ability of workers to unionize and bargain collectively -- because as we know, unionization and collective bargaining are key priorities in Catholic social teaching."

"And then," Annett concluded, "when it comes to the poor, we want to know if policies are allowing a sufficiently robust income social safety net, to stop families falling into poverty."

By Kimberley Heatherington, OSV News